Debt Management Strategies for Financial Freedom

Debt can feel overwhelming, but with the right strategies, it is possible to regain control and move toward long-term financial freedom. Effective debt management is not about quick fixes—it’s about building smart habits, clear plans, and disciplined financial decisions that reduce stress and create stability.

Understand Your Debt Clearly

The first step to managing debt is knowing exactly what you owe. List all debts, including credit cards, personal loans, student loans, and EMIs. Note interest rates, minimum payments, and due dates. This clarity helps you prioritize repayments and avoid missed payments.

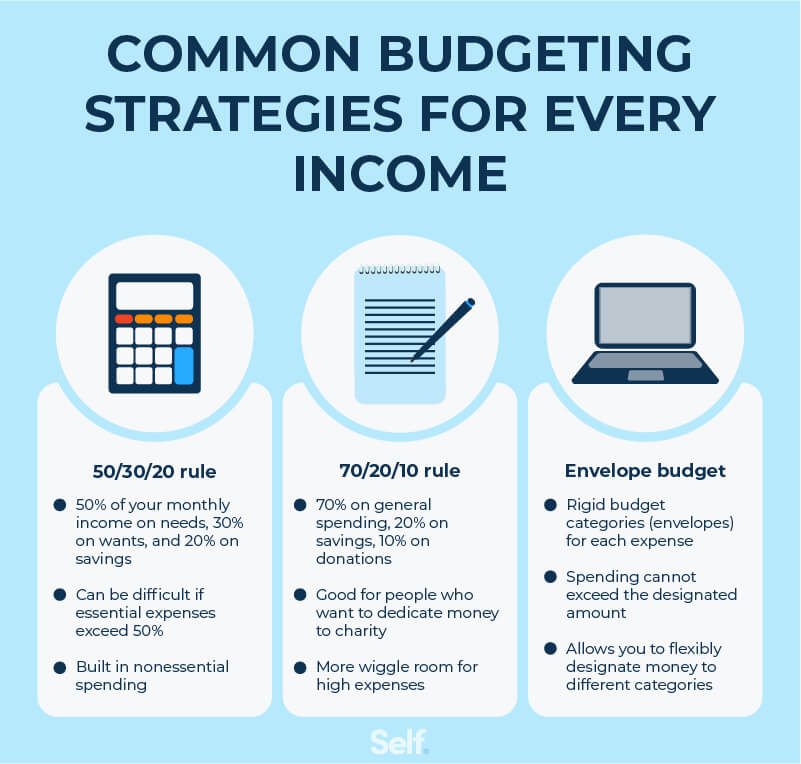

Create a Realistic Budget

A well-planned budget is the foundation of debt management. Track your income and expenses to identify areas where you can cut unnecessary spending. Allocate a specific portion of your income toward debt repayment while still covering essential living costs.

Prioritize High-Interest Debt

High-interest debt grows quickly and costs more over time. Focus on paying off debts with the highest interest rates first while continuing minimum payments on others. This approach reduces the total interest paid and speeds up debt freedom.

Use the Debt Snowball Method

The debt snowball method involves paying off the smallest debts first to gain motivation. As each debt is cleared, the freed-up money is rolled into the next one. This strategy builds confidence and keeps you committed to the process.

Avoid Taking on New Debt

While paying off existing debt, it’s important to avoid adding new financial burdens. Limit credit card usage, delay unnecessary purchases, and focus on living within your means. Discipline during this phase accelerates progress.

Build an Emergency Fund

Unexpected expenses often push people deeper into debt. Creating a small emergency fund helps cover surprises without relying on credit. Even a modest savings buffer can prevent setbacks in your debt repayment journey.

Consider Debt Consolidation Carefully

Debt consolidation combines multiple debts into a single payment, often with a lower interest rate. This can simplify repayment and reduce costs, but it’s important to understand the terms fully to avoid long-term financial strain.

Increase Income Where Possible

Boosting income through side work, freelancing, or skill upgrades can significantly speed up debt repayment. Any extra income should be directed toward clearing debt faster rather than increasing lifestyle expenses.

Stay Consistent and Patient

Debt freedom doesn’t happen overnight. Consistency, discipline, and patience are key. Celebrate small milestones and remind yourself of the long-term benefits, such as reduced stress and greater financial control.

Plan for a Debt-Free Future

Once debts are under control, shift focus to savings, investments, and long-term financial goals. Building healthy money habits ensures you don’t fall back into debt and helps maintain financial freedom.

Final Thoughts

Debt management is a journey that requires awareness, planning, and commitment. By budgeting wisely, prioritizing repayments, avoiding new debt, and staying consistent, you can break free from financial burdens and build a secure, stress-free future.