Financial Planning Tips for a Secure Future

Financial security doesn’t happen by chance—it is built through smart planning, disciplined habits, and informed decisions over time. Whether you are just starting your career or planning for retirement, effective financial planning helps you manage money wisely, reduce stress, and achieve long-term goals with confidence.

Set Clear Financial Goals

The foundation of financial planning is knowing what you want to achieve. Set short-term goals like building an emergency fund, medium-term goals such as buying a home, and long-term goals like retirement. Clear goals give direction to your savings and investments.

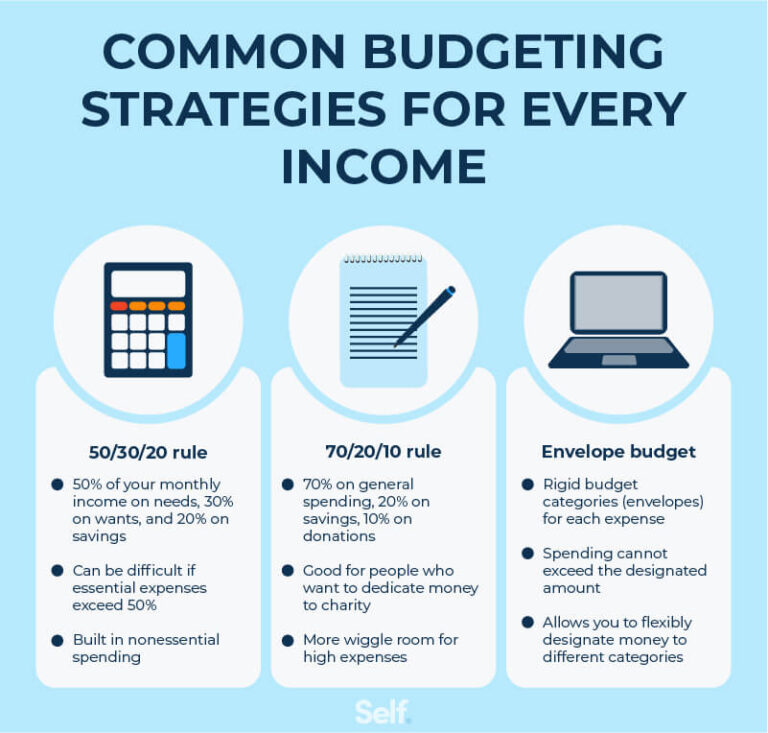

Create and Follow a Budget

A budget helps you understand where your money goes each month. Track income and expenses, prioritize essentials, and limit unnecessary spending. Following a realistic budget ensures you save consistently without compromising daily needs.

Build an Emergency Fund

Life is unpredictable, and unexpected expenses can disrupt financial stability. An emergency fund covering at least three to six months of living expenses provides a safety net and prevents reliance on high-interest debt during emergencies.

Save and Invest Regularly

Saving alone may not be enough to beat inflation. Investing in suitable options based on your risk tolerance and time horizon helps grow wealth over time. Regular investments encourage discipline and benefit from long-term compounding.

Manage Debt Wisely

Not all debt is bad, but uncontrolled debt can hinder financial growth. Prioritize paying off high-interest loans and credit card balances. Responsible borrowing and timely repayments improve financial health and creditworthiness.

Plan for Retirement Early

Starting retirement planning early gives your money more time to grow. Even small contributions made consistently can create a substantial retirement corpus. Planning ahead ensures financial independence and peace of mind in later years.

Protect Yourself With Insurance

Insurance is an important part of financial planning. Health, life, and asset insurance protect you and your family from major financial setbacks. Adequate coverage reduces risk and adds stability to your financial plan.

Review and Adjust Your Plan

Financial planning is not a one-time task. Review your goals, budget, and investments regularly to adapt to life changes such as career growth, family needs, or market conditions.

Final Thoughts

A secure financial future is built through thoughtful planning, smart spending, and consistent saving and investing. By taking control of your finances today, you create a strong foundation for stability, growth, and long-term peace of mind.